Starting an LLC in the Palmetto State can seem overwhelming, but simplifying the process makes it easier. It's necessary to consider your company name, select a trustworthy statutory agent, and get your paperwork in order with the state. There are also key decisions regarding how your business operates and what to do after formation. Each stage has its potential issues, so let’s examine what you shouldn't overlook.

Selecting the Right Name for Your LLC in South Carolina

Your business name establishes the image for your business and helps you stand out in South Carolina’s marketplace. Start by brainstorming names that reflect your brand and vision.

Make sure your business designation is distinct and dissimilar to existing businesses listed in the South Carolina Secretary of State’s database. Your name must include “Limited Liability Company,” “LLC,” or “L.L.C.” and steer clear of prohibited terms like “bank” or “insurance.”

Confirm domain name availability to secure a digital footprint. Once you’ve chosen a compliant, notable designation, you’re prepared for the upcoming stages in establishing your LLC in SC.

{Choosing a Registered Agent

Before you can officially register your LLC in the Palmetto State, it's required to appoint a official contact. This individual or business agrees to accept official papers and government notices on your LLC’s behalf.

Your registered agent must have a physical address in the state and be present during normal business hours. You can opt for yourself, another member of your LLC, or a professional registered agent service.

Just make sure your agent is reliable and consistently reachable. Selecting the appropriate official ensures compliance, guarantees you don’t overlook critical deadlines, and safeguards your business's confidentiality and compliance.

{Filing the Articles of Organization to the Authorities

Once you’ve chosen a statutory contact, you’re ready to formally establish your LLC by submitting the Articles of Organization with the state office.

You can file via the internet, by mail, or personally. Complete the form with your LLC’s registered name, registered agent’s details, company location, and management structure. Verify that everything’s accurate before sending.

There’s a state filing fee, so prepare your payment. If you file online, it’s processed more quickly.

After submission, you’ll receive confirmation. This action legally creates your LLC, allowing your company to operate under the state’s safeguards and rules.

Creating an Internal Contract

Many companies overlook the significance of an internal document, but this document is crucial visit the website to defining how your LLC will be governed.

By drafting an internal guideline, you set clear rules for management structure, partner duties, revenue distribution, and how decisions get made.

Even though the state does not mandate this agreement by law, it’s essential for avoiding disputes between partners and protecting your limited liability status.

You’re allowed to tailor terms to suit your business needs.

Store a signed copy with your crucial documents, making sure every partner has acknowledged and consented to its terms before moving forward.

Meeting Regular Regulatory Obligations

With your internal contract in place, it’s important to keep your LLC in good standing by following the state’s continuous legal obligations.

Every year, it's necessary to file an annual report and pay the associated fee if your LLC is taxed as a corporation. Always ensure agent details are updated to prevent overlooking important papers.

Maintain precise logs of your business activities and finances. If your LLC’s structure or ownership changes, report these updates to the Secretary of State.

Staying on top of these obligations guarantees you protect your limited liability status and avoid fines or administrative dissolution.

Conclusion

Forming an LLC in South Carolina isn’t as complicated than it seems. When you take it step by step—choosing the right name, appointing a registered agent, filing your Articles of Organization, and creating an Operating Agreement—you’re setting your business up for success. Don’t forget about ongoing compliance to keep your LLC in good standing. With a little organization and diligence, you’ll enjoy the benefits and safeguards that come with having your own LLC in SC.

Neve Campbell Then & Now!

Neve Campbell Then & Now! Alisan Porter Then & Now!

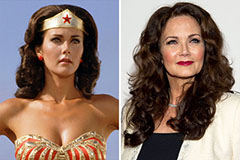

Alisan Porter Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!